The Changing Crypto Environment

The cryptocurrency landscape is witnessing a significant transformation, especially with the rise of the International Organization of Securities Commissions (IOSCO). This organization plays a crucial role in redefining cryptocurrencies beyond just digital commodities like Bitcoin. Its efforts are primarily focused on regulating the trading of cryptocurrencies to ensure greater security and compliance within the financial ecosystem.

In response to this evolving regulatory environment, Uniswap, a prominent decentralized exchange (DEX), is taking a groundbreaking step by integrating Know Your Customer (KYC) protocols into its platform. This move, while seen as controversial by some in the decentralized space, is a strategic alignment with the latest regulations. It underscores a crucial fact: if platforms, decentralized or not, wish to continue operating, their development teams must adapt their protocols to be compliant with these emerging regulations.

The Dual Role of Money: Settlement and Prevention of Illicit Activities

The purpose of money extends beyond merely settling ledgers. It plays a pivotal role in preventing severe societal issues like human trafficking and money counterfeiting. This protective aspect is one of the key drivers behind the shift towards digital currencies. In the digital realm, the smart contracts that underpin assets cannot be faked, enhancing security. However, this also brings to the forefront the importance of protocol security—monitoring who uses a platform and how the money is utilized.

Circularity Finance: Bridging the Gap with New Financial Systems

Recognizing the need for new financial systems to facilitate this transition for the public, corporates, and financial institutions, Circularity Finance emerges as a crucial player. It offers an innovative approach to onboarding, significantly lowering the cost of developing and deploying digital assets. Moreover, its platform enables crowdfunding and capital management through a Decentralized Autonomous Organization (DAO), providing a comprehensive on-chain banking experience powered by automated smart contracts.

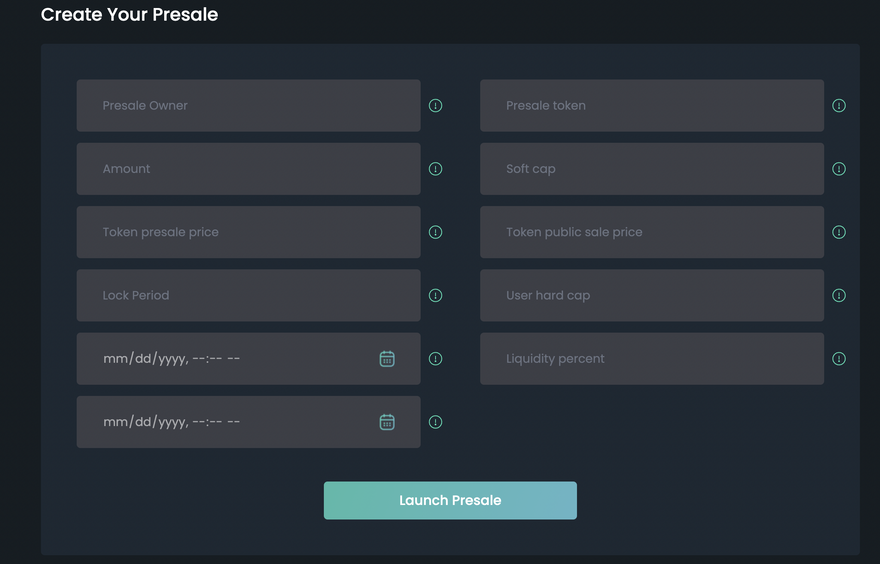

Innovation through the Initial Liquidity Offering Platform

Circularity Finance's most significant contribution is perhaps its Initial Liquidity Offering platform, also known as the Private Equity Launchpad. This platform revolutionizes the user experience by allowing them to create and manage their tokens, organize private sales for their community, and eventually trade these tokens on a regulated platform.

A notable feature of this system is the allocation of raised capital. Ideally, 100% of this capital is directed to the CIFI Swap Public liquidity pool, thereby assigning an on-chain price to the token based on the available tokens and liquidity in the pool. This mechanism is a game-changer as it enables micro-economy tokens to gain a legitimate and real market price, offering a transparent and regulated way for users to invest and participate in the burgeoning crypto economy.

A Beginner's Guide to Value and Security: Vesting Contracts

Cryptocurrency and blockchain technology have introduced novel ways of managing and distributing digital assets. One of the key innovations in this space is the Vesting Contract.

It's a set of coded rules that governs the distribution of tokens or digital assets. This contract ensures that tokens are released over a period, according to pre-defined rules set by the developers or the project team. The primary aim is to control the circulation of tokens and prevent market manipulation or dumping of tokens by early holders.

Benefits for the Public and Investors

Market Stability: By controlling the release of tokens, Vesting Contracts help in maintaining market stability. This is beneficial for both casual holders and serious investors, as it mitigates the risk of market manipulation.

Long-term Commitment: These contracts encourage long-term commitment from project founders and team members, as they receive their token rewards over time. This aligns their interests with the project’s success.

Investor Confidence: Investors can be more confident in their investments knowing that there's a structured, transparent system for token distribution. This reduces the fear of early investors dumping their tokens immediately after an ICO or token launch.

Encouraging Proper Use of Funds: In cases where funds raised from token sales are released through Vesting Contracts, it ensures that the funds are used appropriately over time, rather than being misused or spent hastily.

Attracting Serious Projects: The use of Vesting Contracts is often seen as a sign of a serious and well-planned project, which can attract more investors and increase the credibility of the project.

For beginners in the cryptocurrency space, understanding the role and importance of Vesting Contracts is crucial. These contracts bring a level of discipline, stability, and trust to token distributions, benefiting both the general public and investors. As the crypto market continues to mature, the adoption of such mechanisms will likely become more widespread.

In the same fashion, as the crypto space evolves with increasing regulatory oversight, platforms like Uniswap are adapting to ensure compliance and longevity. This shift opens up opportunities for innovative platforms like Circularity Finance, which are well-positioned to lead the transition towards a regulated, secure, and user-friendly crypto economy. By offering comprehensive solutions that align with regulatory requirements and user needs, Circularity Finance is setting a new standard in the digital finance landscape, marking the beginning of a new era in crypto trading and asset management.

Revolutionizing Investor Protection & Access through VIP NFTs

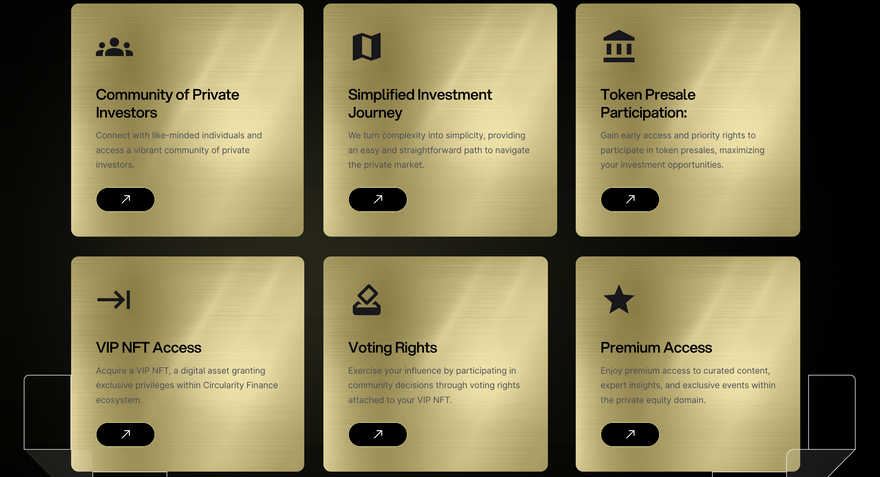

The CIFI ILO (Initial Liquidity Offering) platform is setting new standards in the cryptocurrency space by integrating innovative measures to ensure investor protection and exclusive access to private equity sales. Central to this approach is the use of a VIP NFT (Non-Fungible Token) membership, which not only safeguards investors but also aligns with impending global regulations for digital assets.

Understanding the VIP NFT Membership

The VIP NFT is a unique offering by the CIFI platform, providing holders with a plethora of benefits and privileges. Priced at 10,000 XDC, this NFT serves as a gateway to various exclusive features:

Access to Private Equity Sales: One of the most significant advantages is the exclusive access to private equity sales. This feature enables VIP NFT holders to invest in the latest projects launching on CIFI at preferential prices.

Voting Rights: VIP NFT holders are empowered to vote on proposals and decisions set forth by the Governors of the CIFI platform, allowing them to actively participate in the governance of the ecosystem.

Staking for REFI: Holders of the VIP NFT can stake their tokens to earn REFI, adding an investment and reward layer.

Aligning with Global Regulations

CIFI's strategy is not just about immediate benefits; it's also about future-proofing. The platform is aligning itself with the anticipated regulations from major financial regulatory bodies like the Financial Stability Board (FSB), International Organization of Securities Commissions (IOSCO), Bank for International Settlements (BIS), and Financial Action Task Force (FATF). These bodies are expected to implement new global regulations for digital assets, and CIFI’s approach positions it well for these changes.

The Future of Financial Institutions and Digital Assets

Looking ahead to 2024 and beyond, financial institutions and central banks are expected to deepen their commitment to digital asset technologies. Notably, starting in 2025, central banks might begin holding up to 2% of digital assets on their balance sheets. This move would be a monumental shift in the financial landscape, indicating a growing acceptance and integration of digital assets in mainstream finance.

Taking Action

CIFI ILO is pioneering a new path in the crypto space, prioritizing investor protection while offering exclusive access and benefits through its VIP NFT system. By aligning with upcoming global financial regulations and providing a platform for secure investment in digital assets, CIFI is not just offering immediate advantages to its users but is also positioning itself as a key player in the future of digital asset management and regulation compliance.

Get Your Own VIP NFT

Unlock Exclusive Opportunities in Private Equity with Circularity Finance VIP Membership

CLICK HERE To Access A Community Of Private Investors.

Discussion (2)

The International Organization of Securities Commissions has 9 Recommendation for the DEFI use cases--potential global regulations to soon...Interesting new recommendations for the creators /founders along with things to look at governance...

Interestingly ... KYC for users is not something important but identification of stakeholders seems top priority 🤔.

Great view point from Circularity team

Interesting to see how CIFI is positioning itself within the crypto landscape. OTC trading is a crucial aspect for institutional adoption, and exploring its integration with CIFI's offerings could be a strategic move. While the blog focuses on micro-economies, mentioning how CIFI might leverage OTC partnerships with established crypto otc desk for larger transactions could be a valuable addition.