Micro-economies in digital communities, particularly those leveraging blockchain technology, represent a novel approach to creating value and solving world problems. These micro-economies are distinct from traditional corporate structures in several key ways, focusing on decentralization, democratization of access, and community-driven development.

Let's delve into how Circularity Finance & Circularity Labs view these micro-economies function and their goals:

Definition and Functioning of Micro-Economies

1. Digital Assets on Blockchain: In these micro-economies, digital assets, often in the form of tokens or cryptocurrencies, are used as a medium of exchange, store of value, or a unit of account. Leveraging blockchain technology ensures these assets are secure, transparent, and decentralized.

2. Creation of Digital Roles: These economies use digital assets to assign and define roles within their communities. These roles can be based on various factors such as the size of investment, level of authority, position in the community, or unique benefits accorded to the users. For instance, a larger investment might grant a user more voting power in community decisions.

3. Identification and Incentives: Users are identified and incentivized based on their contributions, roles, or investment sizes. This creates a more engaged and active community, as members are rewarded for their participation and contributions, fostering a sense of ownership and responsibility.

##Goals of Micro-Economies

1. Solving World Problems Outside Traditional Structures: Unlike traditional corporate structures that are often hierarchical and profit-driven, micro-economies aim to address global challenges by incentivizing public participation in value-creating protocols. This approach is more grassroots and democratic.

2. Incentivization for Public Participation: By offering tangible incentives (like tokens or digital assets), these micro-economies motivate the public to engage in activities that bring value not just to the individual community but potentially to humanity at large. It's a shift from shareholder value to stakeholder value.

3. Creating Successful Markets through Value-Driven Protocols: The focus is on developing protocols or systems that inherently bring value, such as improving transparency in transactions, enhancing data security, or facilitating decentralized finance (DeFi). The success of the market is not solely measured in financial terms but also in terms of the value added to society.

4. Decentralization and Democratization: By decentralizing the control and democratization of access, micro-economies challenge the traditional corporate power structures. They empower individuals to have a more significant say in how things are run and ensure that the benefits are more evenly distributed.

5. Community-Driven Development: These economies thrive on community participation and decision-making. This could manifest in various forms, such as decentralized autonomous organizations (DAOs) where decisions are made collectively by the community members.

Micro-economies on the blockchain represent a paradigm shift in how value is created, distributed, and utilized. By leveraging digital assets to establish roles and incentivize participation, these communities aim to tackle global issues through collaborative, decentralized, and democratized means. This approach stands in contrast to traditional corporate structures, focusing more on collective benefit and societal value rather than solely on profit.

Breaking down the complexity of the relationship between a micro-economy's commodity token (like an XRC20 token on the XDC Network) and the denomination of a community's digital assets in that commodity requires an understanding of several interconnected concepts: the nature of the token, the dynamics it creates in the community, and the external factors influencing its price. Let's explore these elements:

**

Nature of Commodity Tokens in Micro-Economies

**

1. Commodity Token (XRC20 on XDC Network): These tokens represent digital commodities within a blockchain network. In the case of the XRC20 token on the XDC Network, it's a standard for tokens, similar to Ethereum's ERC20, but tailored for the XDC Network's ecosystem. These tokens can represent any tradable good: coins, loyalty points, gold certificates, IOUs, and more.

2. Denomination of Digital Assets: In a micro-economy, digital assets, services, or resources can be denominated in this commodity token. This means that the token acts as a standard unit of value for transactions within the community.

Unique Dynamics Created by Commodity Tokens

1. Utility-Driven Demand: The primary demand for these tokens arises from their utility within the network. For example, they might be used to access certain services, execute smart contracts, or participate in governance.

2. Price Influenced by Utility and Demand: The more utility a token has (i.e., the more it can be used within the ecosystem), the greater the demand for the token, which can positively affect its price.

Need for Public Education on Price Metrics

The need for public education on price metrics and the factors influencing token values in the blockchain and cryptocurrency space cannot be overstated. A well-informed public is more likely to make reasoned and careful investment decisions, contributing to a more stable and mature crypto market. This education should encompass a comprehensive understanding of market dynamics, diverse metrics affecting token prices, and the inherent risks and volatility in crypto investments.

Beyond Utility - Market Dynamics: While utility is a key driver of a token's value, it's not the only factor. Market sentiment, investor behavior, regulatory changes, and broader economic conditions can also significantly impact the token's price.

Educating on Diverse Metrics: There's a need to educate the public on various metrics affecting the price of these tokens. This includes understanding liquidity pools, trading volumes, token utility, market trends, and macroeconomic factors.

Risks and Volatility: Part of this education should also cover the inherent risks and potential volatility in trading and investing in these tokens. This knowledge is crucial for informed decision-making in investments.

The realm of cryptocurrency and token economics is often complex and nuanced, especially when it comes to understanding the factors that influence token prices. Public education in this area is not just beneficial but essential for fostering a well-informed community of investors and participants in the blockchain space.

This all helps to highlight the correlation between a micro-economy's commodity token, like an XRC20 token on the XDC Network, and the denomination of community assets in that token, creating a dynamic ecosystem. This ecosystem's stability and growth are influenced not only by the token's utility but also by external factors like marketing strategies, liquidity pools, and broader market dynamics. Educating the public about these various factors is essential for fostering a well-informed community capable of making wise investment decisions and contributing to the sustainable growth of the micro-economy.

The concept of Decentralized Applications (DApps) empowering micro-communities through the use of XRC20 tokens on the XDC Network offers a rich and complex ecosystem of digital asset management and value distribution. These DApps act as pivotal agents in both driving the demand (velocity) for the community's XRC20 tokens and in redistributing value within the ecosystem. Let's expand on this concept:

DApps as Agents of Token Velocity

1. Incentivizing XRC20 Token Purchase: DApps provide essential services or access to digital assets within the micro-community. To utilize these services or purchase these assets, community members must acquire and spend the community's XRC20 tokens. This requirement creates a continuous demand for the token, driving its velocity within the ecosystem.

2. Pricing Power: These applications empower communities to set the price for their digital assets and commodities, as well as the fees for various protocol services, in their native XRC20 token. This autonomy in pricing helps maintain the internal economic balance and encourages the use of the token.

DApps as Agents of Value Redistribution

1. Smart Value Distribution: DApps can be programmed to automatically redistribute value within the ecosystem. By using smart contracts, a portion of the fees or revenues generated within the DApp can be allocated to different ecosystem wallets, supporting various community initiatives or governance activities.

2. Influence on Liquidity Pools: These automated transfers and redistributions of value can directly influence the amount of liquidity being added to the XRC20 liquidity pools. By continually injecting value into these pools, the ecosystem ensures stability and liquidity for token transactions.

_

Example: NFT Marketplace

_

An illustrative example of this mechanism is an NFT marketplace within the community:

- Fee for Service: The marketplace charges a fee, say 10 XDC, for deploying an NFT collection.

- Buy-Back Mechanism: The application then redirects these collected fees to a specific wallet programmed to perform a 'buy-back' of the community's XRC20 token.

- Reducing Market Supply: This buy-back mechanism effectively removes XRC20 tokens from the open market, creating a consistent demand. This demand is not based on market speculation but on a cyclical buying structure tied to the usage of the marketplace.

- Programmed via Smart Contracts: The entire process, from fee collection to buy-back execution, is automated and executed through smart contracts. This ensures transparency, security, and efficiency in the redistribution of value.

In essence, DApps in such micro-economies serve dual roles. Firstly, they act as catalysts for the velocity of the community’s token by providing valuable services and assets that require the token for access. Secondly, they play a critical role in the smart redistribution of value within the community. This dual functionality not only ensures the active use and demand for the community's token but also contributes to a fair and transparent economic model within the micro-economy, all governed by the immutable and trustless nature of blockchain technology and smart contracts.

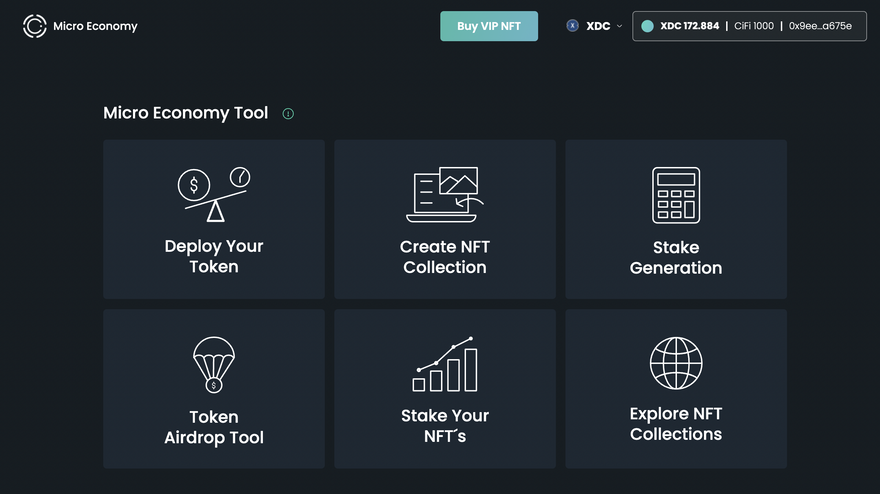

To learn more about how to create your own micro-economy, make sure to visit the CIFI Launchpad

Discussion (1)