Plugin is working on to provide the PoR as a service to crypto based centralized exchange and other crypto backed businesses. PoR in Plugin provides cryptographical attestation to the audit result of the reserve. The hash generated out of the audit result is checked periodically with the latest state of the audit from the audit firm.

Plugin has implemented the PoR in Staking for yield farming use case. In yield farming our node operators staking & re-staking assets were aggregated and provided in a transparent manner. Through this approach we gained the confidence of our stakeholders and also our transparency in publishing the reserve has got laurels across our community.

Having said that, similar approach will be applied on other crypto backed and fiat backed stable coins. There are many crypto backed assets in the market , which requires Proof of Reserve to bring transparency and entrust to their stakeholders. In implementing this service the fintech institutions which guard the reserve and provide the audit service will be part of the ecosystem, to bring real time data for periodical verification.

Let’s get into the intricacies of “Proof of Reserve”, to understand what Plugin is trying to offer!!

What is Proof of Reserve?

Decentralized finance, or "DeFi", is a rapidly growing sector of the cryptocurrency industry that enables financial transactions to occur on a decentralized, blockchain-based network. One of the key features of DeFi is the concept of "proof of reserve", which is a mechanism used to ensure that a decentralized platform has the assets it claims to have in order to back its operations.

Proof of reserve is a way for a DeFi platform to demonstrate to its users that it holds a certain amount of assets, such as cryptocurrencies, in reserve. This is important because it gives users confidence that their investments or transactions will be backed by real assets, rather than just being a promise on a whitepaper.

There are several different ways that a DeFi platform can prove its reserve. One common method is through transparency and publicly accessible smart contract. By making its reserve holdings transparent, a platform can demonstrate that it has the assets it claims to have and that they are being properly secured.

Proof of Assets (PoA)

- The simplest form of proving asset ownership is for an exchange to claim a wallet, and then make a transaction with the crypto inside of it.

- By digitally signing a transaction, the exchange proves it controls the private keys and thus owns the wallet.

Proof of Liabilities (PoL) and Merkle Trees

- Proof of Liabilities in simpler terms, funds an organization owes its customers.

- Publishing Proof of Liabilities for any organization in crypto space has a significant risk of exposing the user name and user deposits.

- To mitigate the risk, Proof of Liabilities is carried out with the help of Merkle Trees.

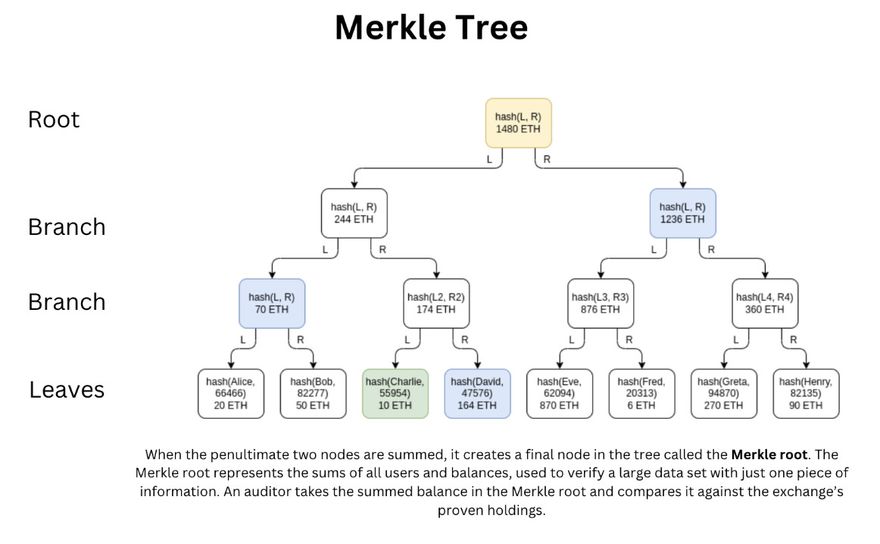

- In a Merkle tree, data about each individual depositor (name + balance of deposits) is recorded as “leaves.” Usernames are cryptographically converted into data called hashes to provide a layer of protection.

Proof Of Reserve

Proof of Reserves is simply the audit of a firm’s funds by a third party. During the process of PoR, an exchange provides information to demonstrate its ability to cover user withdrawals with assets held in its reserves. The auditor then publishes its findings for the public.

How does Proof of Reserve works

- If a crypto entity can show it owns a specific wallet, this would provide the requisite Proof of Assets (PoA).

- If it can also attest to the sum of user deposits, this would fulfill a Proof of Liabilities (PoL).

- Together, these confirm what the community really hopes to ensure: Proof of Reserve. Thus PoR = PoA + PoL

Limitations of Proof of Reserves:

- First, PoR only provides a snapshot in time of current holdings. This does not prevent institutions from moving assets around before and after the PoR audit.

- Another limitation of PoR is scope since PoR only assures a company's holdings and liabilities (if done right) at a moment in time, and not other risks. Companies can still be vulnerable to other factors such as bad economic environment, poor internal management, or even hacks.

- Finally, audits do rely on a third party to verify that everything is in order. That means that, in a space where decentralization and trustlessness are prized, a little trust in third parties is necessary when conducting PoR.

In conclusion, proof of reserve is a crucial aspect of decentralized finance. It gives users confidence in the platform's ability to meet its obligations, and helps to maintain the stability of the platform. Platforms can prove their reserves through transparency and publicly accessible smart contract, or by using third-party auditors to verify their reserve holdings. As the DeFi space continues to grow and evolve, proof of reserve will likely become an even more important consideration for users and platforms alike.

Discussion (0)