Have you come across the news creating a buzz in the trade finance world?

You got it right! It’s a recent transaction in the trade finance asset tokenization by one of the leading securitization technology firms, Tradeteq. It is the first of its kind where a trade asset finance transaction is executed on Blockchain.

Well, if you haven’t got a chance to get a glimpse of the news, here it is.

Let me brief you on how it all started.

You all know that XinFin is a global open source Hybrid Blockchain protocol with independent community contributors comprising long-term backers, network utility, and tech developers that help build various enterprise use cases. XinFin became the first Blockchain to join the Trade Finance distribution (TFD) initiative a while ago. The initiative was established to address the business and regulatory frameworks impacting market participants in the distribution and investments related to trade finance. In addition, the initiative aims to define new tech-based market practices and data specifications so that transparency and accessibility are enhanced in the trade finance flows.

Xinfin has partnered with Trade Teq, a Europe-based company, to offer tokenized trade finance products to institutional investors. This trade finance transaction on Xinfin (XDC Network ) is the first end-to-end trade finance-based non-fungible token (NFT) transaction adhering to a set of regulatory guidelines and trade finance standards. Thus, it has embarked upon a new journey, opening up opportunities for market participants to further the innovation in the trade finance distribution space, especially around DLT.

The offering was created utilizing XDC Network’s enterprise-grade blockchain technology for transforming the trade finance business. The trade finance assets are repackaged and distributed by Trade Teq as non-fungible tokens. Further, these tokens representing the value of an off-chain asset can be traded (buy & sell) by institutional investors. It also gives legal ownership of the underlying off-chain asset or pool of assets to the token holders.

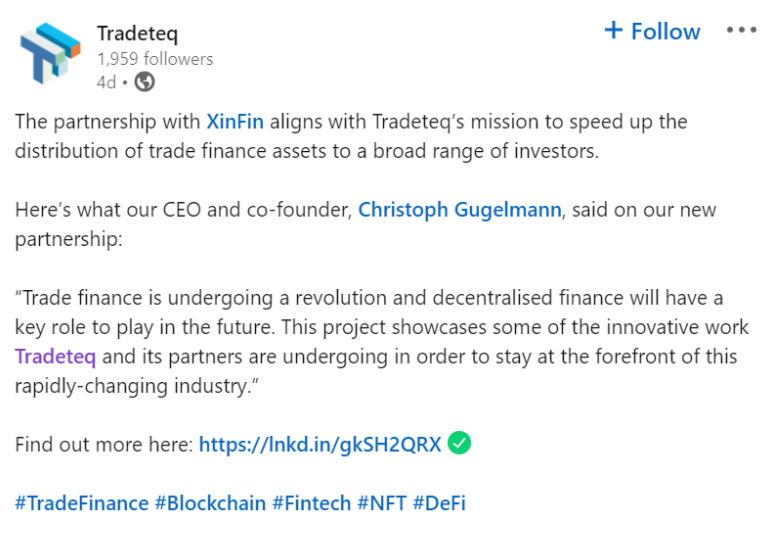

Let me detail to you the business process of the aforementioned trade asset tokenization on blockchain. The entities involved in this transaction were:

- The Issuer (Trade Asset Securitisation Company SARL)

- Originator (Accelerated Payments Limited)

- Xinfin Blockchain Platform

- Off-chain & Digital Asset Trustee & Custodian

- Investor Entity

Blockchain Fintech firm Yodaplus has developed the tokenization platform for trade assets that seamlessly integrate the ecosystem participants on a single coherent platform on XinFin Blockchain.

The Token Issuance Process

Token Definition & Smart contract setup

- Setting up Token Terms, economic attributes, eligibility criteria & transfer restrictions.

- Secured documentation to support the business process and ownership of real-world assets for token holders

- Setting up the KYC and AML process to whitelist the blockchain addresses for allotment.

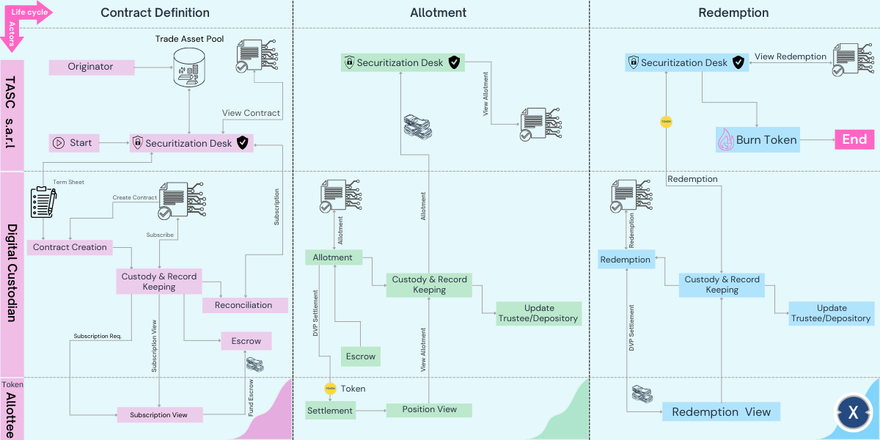

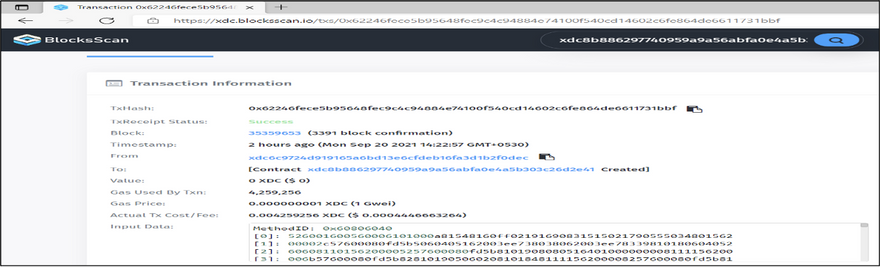

Transaction Hash of the token creation

https://xdc.blocksscan.io/address/xdc8b886297740959a9a56abfa0e4a5b303c26d2e41

https://xdc.blocksscan.io/txs/0x62246fece5b95648fec9c4c94884e74100f540cd14602c6fe864de6611731bbf

Settlement Process :

Legal Documentations supporting the transaction are securely stored on the IPFS blockchain & SHA 256 document hashes are stored on the smart contract.

In the Below Code Snippet , We can see that the SetDocument method only allows owner of the token and the whitelisted investors to set the document on a contract.

function setDocument(bytes32 _name, string calldata _uri, bytes32 _documentHash) external {

require(_name != bytes32(0), "Zero value is not allowed");

require(bytes(_uri).length > 0, "Should not be a empty uri");

if (isOwner() || isWhitelisted(msg.sender)) {

if (_documents[_name].lastModified == uint256(0)) {

_docNames.push(_name);

_docIndexes[_name] = _docNames.length;

}

_documents[_name] = Document(_uri ,_documentHash , now);

emit DocumentUpdated(_name, _uri, _documentHash);

}

}

The tokens are issued to the Investor against the bank wire remittance as a DVP settlement.

The issue method is called to mint the token to the investors which check if the issuance is closed and if the investors have been whitelisted or not and returns appropriate error codes.

function issue (address _tokenHolder, uint256 _value, bytes calldata _data) external onlyOwner return (bool status,bytes32 transStatusCode) {

require(issuance, "Issuance is closed");

if(isWhitelisted(_tokenHolder)){

_mint(_tokenHolder, _value);

emit Issued(msg.sender, _tokenHolder, _value, _data);

return true,0x00;

} else {

return false,0x01;

}

}

The Token trustee, Originator, Issuer, and Investor are given access to the secured documentation using smart contracts methods.

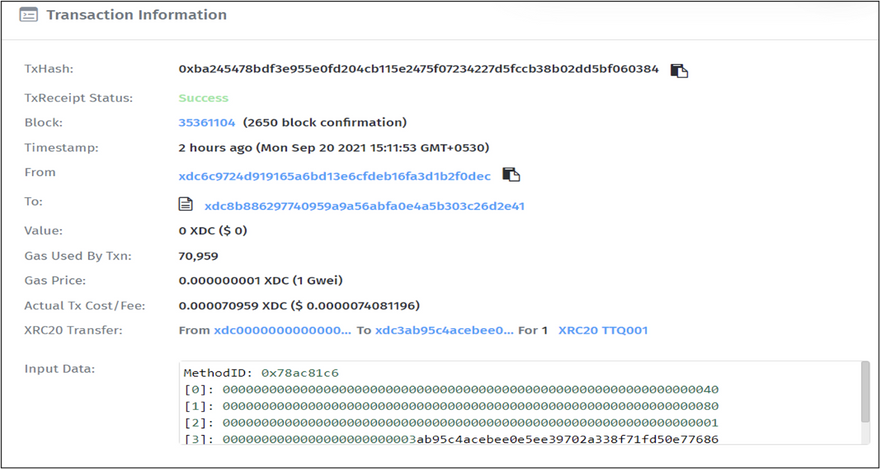

Following this transaction on the block explorer, we can see that the final transaction hash points to the allotment of tokens to a subscriber entity.

Transaction Hash — Token allotment Transaction

https://xdc.blocksscan.io/txs/0xba245478bdf3e955e0fd204cb115e2475f07234227d5fccb38b02dd5bf060384

Redemption:

Upon maturity of the Token, as defined in the Token term sheet, these tokens will be redeemed at a future date and subsequently be burnt by the issuer.

Let’s have a glimpse at what the key people behind this new technology revolution in trade asset finance have to say.

Xinfin’s Head of Ecosystem, Billy Sebell shares his excitement — “We are excited by the future potential of this ground-breaking partnership with Tradeteq. Decentralized finance represents the future, and industry-wide participation relies on the development of robust, enterprise-grade infrastructure. By working with multiple institutions and stakeholders operating in the global trade ecosystem, we are laying the groundwork for distributing tokenized bank-owned assets in a standardized and secure manner through the XDC Network’s hybrid blockchain ecosystem. Tradeteq’s technology will be crucial to achieving this goal.”

Christoph Gugelmann, Co-Founder and CEO of Tradeteq, adds: “The partnership aligns with Tradeteq’s mission to speed up the distribution of trade finance assets to a broad range of investors in the new digital age. Trade finance is undergoing a revolution and decentralized finance will have a key role to play in the future. This project showcases some of the innovative work Tradeteq and its partners are undergoing in order to stay at the forefront of this rapidly-changing industry.

Signing off:

As is evident from the growing appetite from the banks and institutional investors seeking to add digital assets to their portfolios, the platform’s launch is seen as a potential pathbreaker in the trade finance space. And, the future is ours to ideate, experiment, explore and establish.

The original article is published here.

Discussion (0)