Inspiration

Ever since blockchain got introduced I am very bullish about the technology. I always wanted to bring centralized financial products and link it with blockchain technology. One such I'm working on is DeBank.

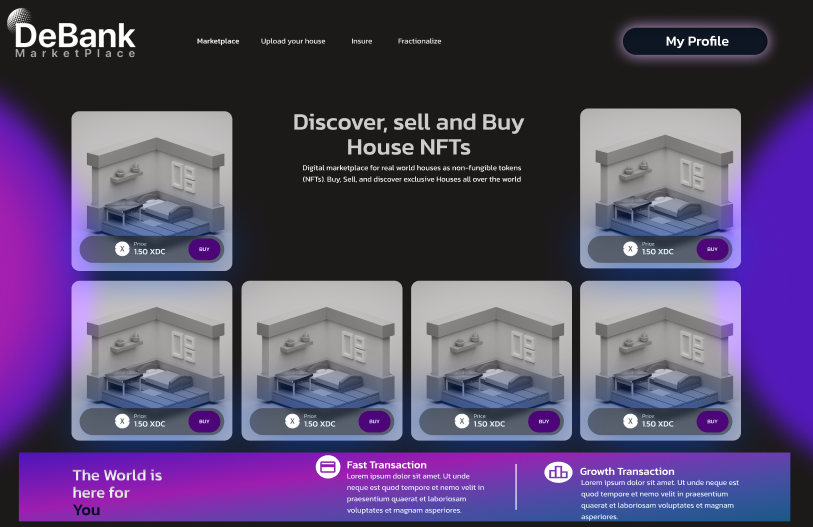

What it does

De-Bank De-Bank is very similar to a day-to-day bank in a real life but powered with blockchain technology and runs in the blockchain world. We are coming up with a new financial product called 'NFTHomes' where users can mint their home documents on our platform and make it into a NFT. The minted NFT's can be sold to a buyer by which the smart contract transfers the digital ownership to the respective person who bought it. DeBank is not just a regular bank. Where we stand out from a normal bank is by providing home loans which are paid in cryptocurrencies. Not everyone today can buy their dream homes, some might have less funds and some might be in a difficult situation to raise funds. So buyers Can approach our Home Loans which are processed 10x faster than a normal bank without any documents or their credit score. Home Loans, Insurances, Yield Farming(Lending and Borrowing) is few of our financial products.

How we raise the capital for buyers?

To raise the capital we also introduce another banking service called 'yield farming' where public can stake XDC Tokens and we as a platform return them equivalent stable coins for the amount of XDC tokens they staked. Stable coins can be used for trading. Once they wish to un-stake it they are asked to return the stable coins to us and we would return them XDC tokens + Interest Rate back for lending us use the money. The stable coins are then burnt.

How Home Loans work?

The raised capital through yield farming is now given to the buyers who are in need of home loans. The criteria for the buyers are that

They get to live in the homes but the ownership of the house will be in the name of the contract/DeBank until the loan amount is repaid.

Buyers are asked to have at least 25 percent of the total house value to be on their wallet. This is just to prevent everyone from asking a loan.

The loan repayment should be paid via stable coins of XDC Network.

These are the criteria to avail Home Loans from us without any cibil score or background. The Homes Loans are processed much faster than a regular bank. In case of a Home Loan the transaction is basically done by the bank side as we promise in the smart contract to transfer the NFT to the buyer once he repays the loan to the bank. It creates lot of trust and security between the buyer and the platform.

Concept of Escrow and How Home NFT is a legal document?

Buyers have the misconception of whether digital NFT's are a valid documents. Before executing the transaction a Escrow agent would look at the house of the seller if there is any damage to the house and if buyers can move in safely, after this the escrow agents approves his proposal whether to execute the transaction or not. Since an Escrow Agent has a relationship with local housing department we will link the wallet address of the respective agent. Digital NFT's can help us to file lawsuit in case of any duplication since there can be only one owner to a property. So on the whole there will be a separate team to inspect the house on site.

Fractionalization of Digital Assets

DeBank also introduce another product called fractionalization of NFT's where the owner of the NFT's can split his assets and issue to people in terms of tokens. people pay certain amount of XDC token and receive NFT token of the owners smart contract address. This can be helpful for the owner of the land to transfer to his lower hierarchy.

How Home Insurance Work

DeBank also provides Home Insurances. We collect premium for each month from various users of our platform and provide them instant insurance claims if they meet our criteria. Since the insurance works in the form of smart contracts users can have the trust of giving premium every month. We collect external data for the weather condition with the help of goplugin decentralised oracle

and integrate it on our smart contracts.

Business Model of DeBank

The business model of a DeBank is quite simple. We raise funds from Yield Farming and distribute it to the borrowers for Home Loans. Borrowers are asked to repay the money including the principal + interest within the tenure period. We charge a interest rate of anywhere around 5-9 % initially. We Use Adjustable Rate Mortgage (ARM) for calculating the interest because as a bank we want less risks, so incoming years if inflation peaks we could make use of adjustable rate mortgages and collect a higher interest rate. The interests collected in the repayment is the major source of income for the bank. Some percentage of the profits are given to the lenders who staked their capital. Another source of Income for the bank is through insurance, the collected premium is one major source. We charge higher premiums for homes which are prone to disaster and damage. We charge less premium for houses that are possibly not going to get damaged. If one house gets damaged in total of ten houses then rest 9 collected premiums are profit for the bank. The Insurance product can be later expanded to medical and automobile fields through integration of external API's in smart contract.

Overall Features of DeBank

- Exchange

- Lending and borrowing / Staking

- Instant Loan approval without documents

- Trading of digital assests.

- NFT Real-Estate

- Insurances

- Fractionalization of Land

How we built it

For building the frontend of the bank we are going to use Reactjs framework, for writing the smart contracts we are going to use solidity programming language. To test and deploy the contract we will use truffle suite/hardhat and connect it to the RPC URL of XDC Network.For getting external data we are planning to use PLUGIN ORACLE and integrate in our smart contracts. The house documents are uploaded to IPFS(Inter Planetary File System) for storage over blockchain. We also link metamask/xinpay on our Javascript code. we might also get to use web3 and ether frameworks.

Discussion (0)