Subswap Aggregator on XDC: Current State, Problems, Solutions, and Advantages

1. Problems statement

Currently, there are multiple DEXs on the XDC Network, each with its own liquidity pool and trading pairs. This leads to the problems of fragmented liquidity and price discrepancies.

Fragmented liquidity and price discrepancies lead to the following problems:

- Users have difficulty finding the best trading price

- Increased transaction slippage

- Slower transaction execution speed

2. Solution : deal aggregator

A Subswap aggregator can solve the above problems. The aggregator provides users with the best trading price and the most optimized transaction execution plan by aggregating the liquidity pools and trading prices of multiple DEXs.

Subswap aggregator provides users with the following advantages:

- Better trading prices: Users can find the best-priced solution by exploring all possible trading options through the aggregator.

- Lower transaction slippage: The aggregator can help users reduce transaction slippage, thereby lowering transaction costs.

- Faster transaction speed: The aggregator can optimize the transaction execution path, thereby improving transaction speed.

- Higher liquidity: The aggregator can aggregate the liquidity of multiple DEXs, thereby providing users with greater liquidity.

3. How does it works

- The aggregator collects liquidity pool and trading price data from multiple DEXs

- Based on the user's trading request, the aggregator calculates all possible trading solutions

- Selects the trading solution with the best price, the least slippage, and the fastest execution speed

- Sends the trading instruction to the selected DEX for execution

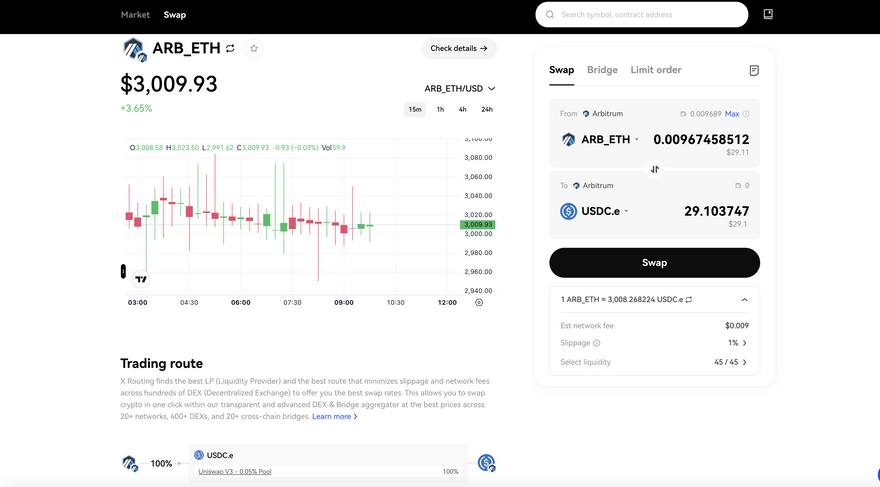

This is a picture of the UI of the okx aggregator

It can be very intuitive and simple to trade the tokens you own, and link multiple swap protocols on the chain.

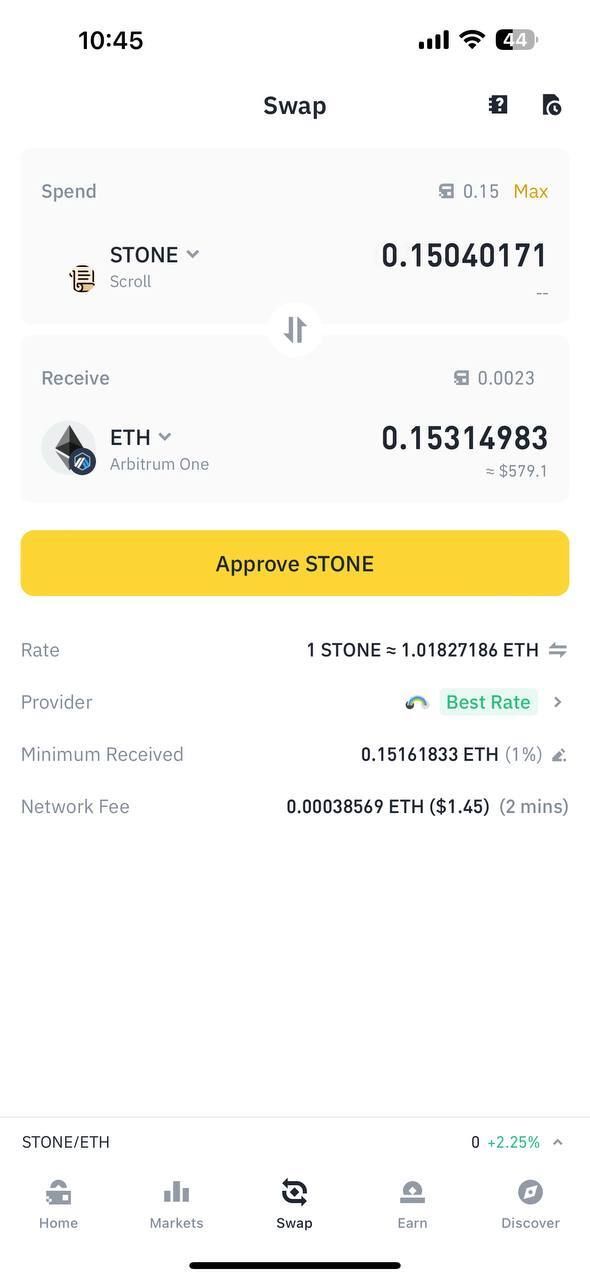

This is a picture of the UI of the binance aggregator

It can use tokens from any chain to exchange for different tokens on different chains.

4. Tentative Proposal

To actualize the Subswap aggregator on the XDC Network, we need a cohesive plan encompassing development, marketing, and operations. Here's a preliminary proposal outlining the key components and a six-month development timeline:

Development Phase (6-12 months)

Research and Analysis: Conduct an in-depth analysis of existing DEXs on the XDC Network, their liquidity pools, trading pairs, and APIs for data collection.

Prototype Development: Build a prototype of the Subswap aggregator platform that can collect data from multiple DEXs, perform price calculations, and generate optimized trading solutions.

Smart Contract Development: Develop smart contracts for executing trades on selected DEXs securely and efficiently.

User Interface Design: Design an intuitive and user-friendly interface for the Subswap aggregator platform, ensuring seamless navigation and accessibility for both novice and experienced traders.

Testing and Optimization: Conduct extensive testing to ensure the reliability, security, and efficiency of the aggregator platform. Optimize algorithms for price calculation, trade execution, and data synchronization.

Integration and Deployment: Integrate the developed components into a cohesive platform and deploy it on the XDC Network. Ensure compatibility with various wallets and trading interfaces.

These numbers are indicative, and the specific personnel requirements should be adjusted and optimized based on the project's specifics and the team's capabilities.

By following this comprehensive plan, we aim to successfully develop, launch, and promote the Subswap aggregator on the XDC Network, providing users with superior trading experiences and contributing to the growth and development of the decentralized finance (DeFi) ecosystem on XDC.

Discussion (0)